Before/After Appraisals

Everything’s bigger in Texas.

So you’ve heard the saying – Everything’s bigger in Texas. Our storms are bigger and our land is bigger. Your home may have been damaged in a flood or hurricane. You may have a piece of property so large you’d like to separate a portion and sell it off, give it to family, or donate it. Or, you may have a mortgage and be looking for the Market Value of the property Before and After the split to get a Partial Release of Lien from the mortgage company.

In any of these instances, Aegis Appraisals can help. Our appraisers are highly experienced in performing before/after appraisals for a variety of uses, and do so with the utmost professionalism and accuracy.

Natural Disasters

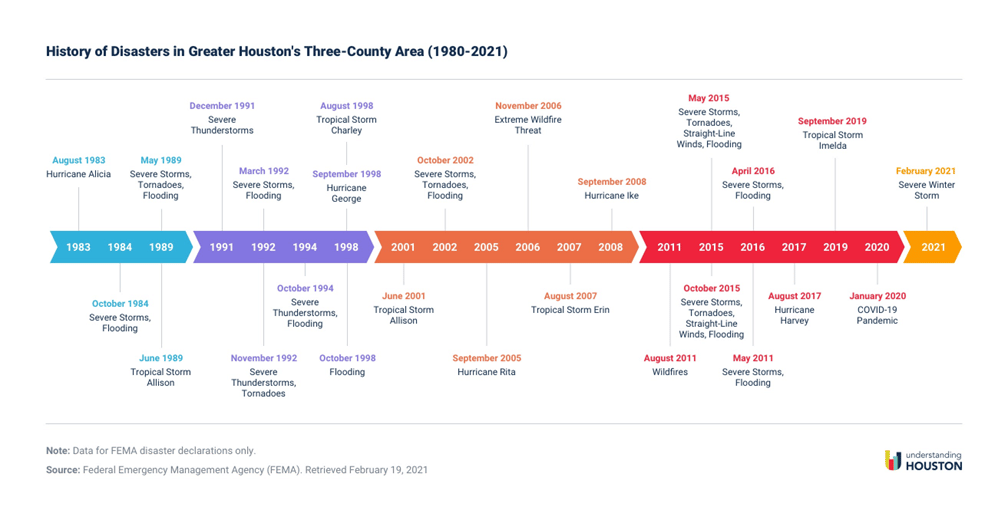

You can’t stop Mother Nature. And here in Texas’s gulf coast region, we are no strangers to natural disasters. Flooding and hurricane events have been a regular occurrence for us. Hundreds of thousands of properties in the region are currently at risk of flooding due to Houston’s relatively flat topography, and that figure is only projected to increase in the coming years as storms become more common and intense:

Source: Understanding Houston

In the event you or someone you know has had their home impacted by natural disaster, you may be able to help mitigate the loss through tax relief from your local county, FEMA, and the IRS. These tax relief programs can assist homeowners able to demonstrate the loss in property value due to the storm by hiring an experienced real estate appraiser in Before/After valuation methodologies. At Aegis Appraisals, we helped thousands of individuals navigate through their recovery process in the years after Hurricane Harvey, and our appraisers are ready should Mother Nature strike again.

Neighborhood flooding after Hurricane Harvey, 2017, Win McNamee

Performing a Before and After Market Value Appraisal is a process that starts with an analysis of the property’s Highest and Best Use. The Appraisal Institute defines highest and best use as “the reasonably probable and legal use of vacant land or an improved property that is physically possible, appropriately supported, financially feasible and that results in the highest value.”

Determining the Highest and Best Use of a property involves applying a set of tests, known as The Four Tests, that comprise the factors an appraiser must consider. Each of these four tests can potentially be a complex and detailed process, but the concept of each is relatively straightforward.

The Four Tests

Legally permissible – Which use cases are permissible by law, zoning, and other land use regulations?

Physically possible – Constructing buildings on the side of a mountain or in a swamp probably isn’t possible.

Financially feasible – Does the use case of the property suit the demographics and market of the area well?

Maximally productive – Does the intended use optimize the potential of the land?

These highest-and-best-use tests aren’t always straightforward to apply, particularly when the property already has improvements on it. Invest in a qualified appraiser at Aegis Appraisals to obtain the most reliable results.